<< Hide Menu

Jeanne Stansak

Haseung Jun

Jeanne Stansak

Haseung Jun

Fiscal policy is the way by which the government can manipulate the nation's economy. They do this in two ways:

- Through government spending

- Through taxation There are two types of fiscal policy and they include expansionary fiscal policy and contractionary fiscal policy. Expansionary fiscal policy refers to laws that increase output by either increasing government spending or decreasing taxes. Contractionary fiscal policy refers to laws that decrease inflation by decreasing government spending or increasing taxes.

Fiscal policy can be both discretionary and non-discretionary. Discretionary fiscal policy occurs when Congress creates a new bill that is designed to change AD through government spending or taxation. A great example in today's economy of discretionary fiscal policy was the stimulus checks that were issued to Americans after many faced job loss due to the temporary shut down of our country due to the COVID-19.

Short-Run Effects

Lags or delays can sometimes occur with the discretionary fiscal policy because it takes time to decide on and implement a policy that will help the economy. Non-discretionary fiscal policy refers to permanent spending or taxation laws already on the books that help regulate the economy. This includes things like social security, welfare, and unemployment compensations.

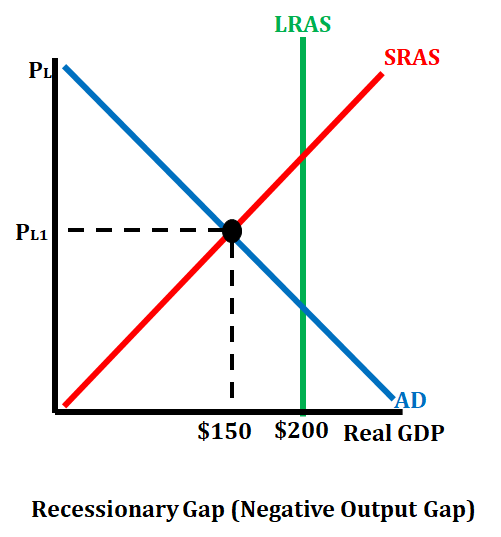

Fiscal policy is mainly used to correct the economy when it is either in a recessionary gap or an inflationary gap situation The government has to decide whether to use government spending or taxation to correct the situation. This depends on the difference between where the economy is currently producing and what its potential output is. This will also be affected by the multipliers which are impacted by the marginal propensity to save and the marginal propensity to consume.

Let's look at a particular situation. What if the economy is currently in a recessionary gap and is producing 200 billion real GDP? The government has to decide whether to use government spending or taxation to correct the economy. They are charged with closing the gap of $50 billion (see graph below).

Types of Fiscal Policies

Expansionary Fiscal Policy

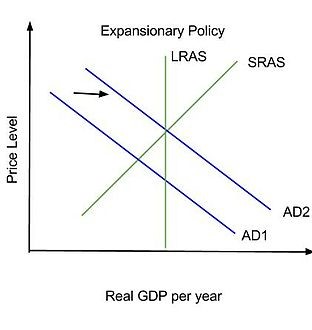

As stated, expansionary fiscal policy is the government's way of getting out of a recession by increasing spending and cutting taxes. In a recession, real GDP is low while unemployment is high. To fix this problem, the government cuts taxes and increases spending. This shifts the AD curve to the right, bringing the equilibrium back. However, a bad side effect is an increase in price levels. LRAS stays the same so real GDP does not change, but because LRAS, SRAS and AD all intersect higher than before, a price level increase is inevitable. Also, because tax multipliers are smaller, it'll have to be greater to make an impact on real GDP. Therefore, the size of tax cut must be greater to match an increase in government spending.

Take a look at the graph below, for example. You'll see that AD1 and SRAS intersect much lower and to the left of LRAS. This signifies a recession. Then, the government enacts a fiscal policy. Now AD will shift right to become AD2 because consumers will likely spend more (less taxes, more money circulating). This brings the equilibrium to where it should be (LRAS), but now the price level higher than before.

Image Courtesy of Wikimedia Commons

Contractionary Fiscal Policy

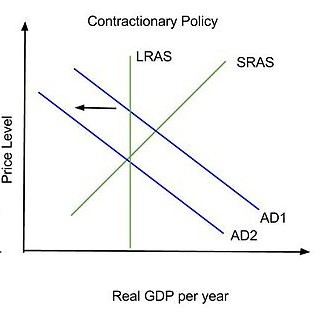

This is a little different. Instead of a recession, we have an economy operating perhaps too well. Inflation is rising quickly and becoming a problem, so the government has to contract the economy a little so people spend less. This is done by decreasing government spending and increasing taxes. This causes AD to shift left this time and brings the price level down. This can, unfortunately cause real GDP to decrease a little, but a substantial decrease in inflation (which is a good thing).

Now let's look at the graph. This time, SRAS and AD1 are intersecting on the right side of LRAS. The government implements a contractionary fiscal policy this time. Now, because people will have less money to spend due to taxes and becaues there's less money circulating, the equilibrium will be at a lower price level.

Image Courtesy of Wikimedia Commons

Calculating Fiscal Policies

In order for the government to help this economy correct itself back to the long-run, it needs to decide the level of government spending or the amount of adjustment in taxes it needs to make. The goal is to shift aggregate demand to the right in an effort to bring it to where it connects SRAS and LRAS at the same GDP level. Since the government is trying to correct a recessionary gap, they need to increase spending or decrease taxes. The question becomes how much do they need to increase spending or how much do they need to decrease taxes. This is where the spending and tax multiplier is helpful in determining these values.

If we said that the MPC was .5, then that means that the MPS is also .5. If you remember from section 3.2, MPC + MPS always equals 1. The spending multiplier is calculated by dividing 1/MPS. So in this particular situation, the spending multiplier would be 2. This means that for every dollar the government spends, it will multiply twice in the economy. Since there is a gap of 25 billion.

Since the MPC is .5, we would calculate the tax multiplier as .5/.5 (MPC/MPS). This would make the tax multiplier 1. So in order to correct this particular economy, the government would have to decreases taxes by $50 billion (the entire value of the gap).

In a situation like the one above where you are trying to encourage spending to close a recessionary gap, government spending will lead to more total spending than a decrease in taxes, because households could potentially save a portion of a tax cut while government spending converts to direct spending into the economy.

**You can apply this same process on an inflationary gap situation except that the government would want to decrease spending and increase taxes. **

© 2024 Fiveable Inc. All rights reserved.