<< Hide Menu

Jeanne Stansak

Haseung Jun

Jeanne Stansak

Haseung Jun

Budget Surplus and Deficit

The Federal budget is the recorded projection of all government expenditures and revenues over the course of a 12 month period. The fiscal year begins on October 1st.

Key Vocabulary

- **Fiscal Stimulus—**The use of expansionary fiscal policy, including an increase in government spending, a decrease in personal taxes, or an increase in income transfers.

- **Fiscal Restraint—**The use of contractionary fiscal policy, including a decrease in government spending, an increase in personal taxes, or a decrease in income transfers.

- **Government Revenue—**The total income gained by the government at all levels, through tax policies, including income taxes, excise taxes, and regulatory taxes.

- **Government Expenditures—**The total spending payments made by the government at all levels, including discretionary and non-discretionary purchases.

- **Budget Surplus—**The condition that exists when government revenues exceed government expenditures. This occurs when tax revenues are more than government purchases plus transfer payments in a given year.

- **Budget Deficit—**The condition that exists when government expenditures exceed government revenues. This occurs when tax revenues are less than government purchases plus transfer payments in a given year.

- **National Debt—**The accumulation of deficits over multiple years. When there is an existence of a large national debt, it will affect government spending in the future. Future spending will fall. Since a government must pay interest on its accumulated debt, this means that the government will not have those funds for alternative uses.

US National Debt

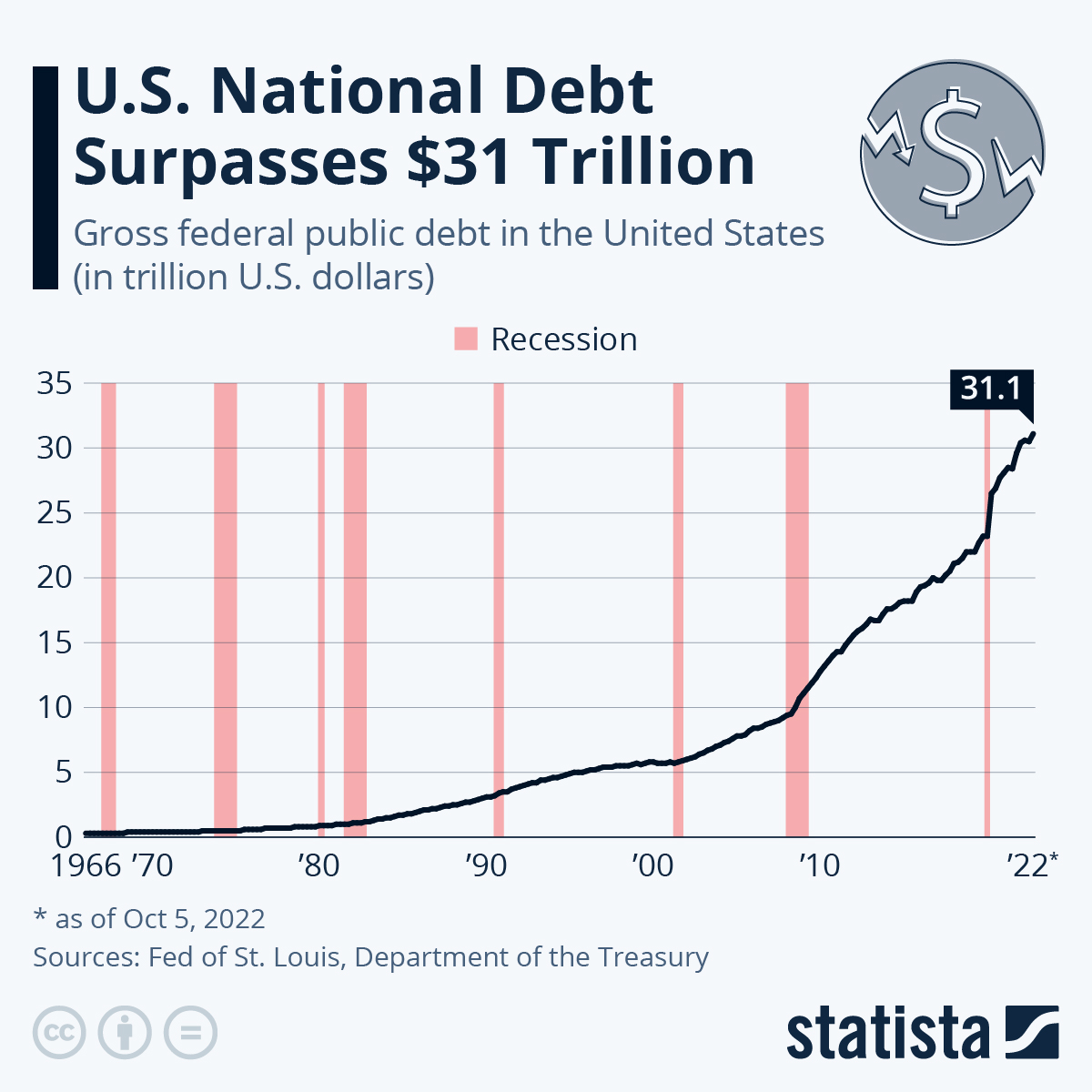

You may already know that the US government's debt is immense. As of 2023, the debt is a huge $31 trillion! That's around 93K per American! So how did we end up with so much debt?

A lot of people can have debts. But they try their best to pay it off, right? But that's not always the case for our government. The government theoretically will never cease to exist. So there's never a point where the debt will "catch up" to us.

Let's think about it this way: if your parents don't pay off their debt, when they die, the debt doesn't just disappear. It's passed onto you. That's why most people work hard to pay off their debts within their lifetime. But what about the government? It's never going to "die" so there's no direct consequence as to what happens if the debt isn't paid off. What that means is that we just don't care as much. Without much to hold us accountable, the debt is always going to be there. The only concern about debt is interest (around $400 billion), but other than that, we keep kicking the can down the street.

Image Courtesy of Statista

Surplus and Deficit

So what's a surplus and deficit? A government surplus happens when the difference between tax revenues and government spending is positive. Meaning, we spent less than we received. When this phenomenon happens, the excess tax revenue is used to pay off the debt borrowed during recessionary times and the interest. A deficit happens when the government spends more than it received as revenue. Quite unfortunately, the US government has been in a budget deficit almost every year since 1969. Only four years during 1969-present have seen a surplus. But that only followed after years of record-high deficits.

The US government has three areas in which it is required to spend a certain amount of money every year. This is called mandatory spending. After that, everything else is part of the discretionary spending, which in that case is up to the lawmakers to decide how much more or less to spend.

The three mandatory spending areas are social security, Medicare, and interest on the national debt. That's it! Not even defense is included!! 🤯

To make matters worse, when the government is in deficit, it'll borrow more, adding to the already enormous debt. On top of that, the government has to pay interest on top of the debt, so national debt just continues to increase no matter what. Even at this second in which you are reading this Fiveable article, the national debt is continuing to increase. You can check it out with the National Debt Clock.

State and Local Debts

Surprisingly, the US Constitution does not mention anything about the government needing to balance the budget. This though it might sound weird, is actually a good thing. Look at the scenarios below:

-

The US is operating in a recessionary gap, where tax revenues are low and spending is high, leading to a deficit.

-

The US is operating in a expansionary gap, where tax revenues are high and spending low, leading to a surplus. In both scenarios, if the Constitution required the state government to balance the budget to exactly zero here's what would happen:

-

Government implements higher taxes and less spending, but this is a recipe for a recession!

-

Government implements lower taxes and more spending, but this is a recipe for an inflation! Get it? If we actually had to balance our budget, we would be in a vicious cycle of recession and inflation. Sometimes, we gotta go into deficit (or surplus) in order to save the sinking economy.

But bad news. Many state and local governments are required to balance the budget. This means during a recession, while the national government is cutting taxes to motivate its citizens to spend more and close the recessionary gap, the state government is increasing taxes and cutting programs (less spending) to balance the budget to make up for the deficit caused by the recession! Sounds like circular logic 😑 Crazy, huh?

So while the state may be increasing taxes and cutting back on education, law enforcement, and transportation because the states have lost federal funds. Do you know what this means? Even if the federal government tries to get us out of an inflation, many state governments are required (by law) to undo those effects. Oh, the irony.

© 2024 Fiveable Inc. All rights reserved.