<< Hide Menu

Jeanne Stansak

Haseung Jun

Jeanne Stansak

Haseung Jun

Public Policy

Last section, we talked about economic growth and how that's measured. Now, we have public policies that can directly or indirectly affect the economy. Public policies that affect productivity and employment affect real GDP per capita, and thus, economic growth. These policies can come in multiple different styles. In addition, if the government invests in the infrastructure and technology, this can constitute growth as well. This is why the government focuses a lot on research and development, in hopes that improvements in technology will bring out a strong economy.

Remember how in the last section we talked about how different factors affect productivity? Well now we're talking about how the government and policies can affect those factors, which was hinted last time.

Types of Public Policy

There are three types of public policy that can promote economic growth:

- Increase in education spending

- By increasing investment in the education of workers, those workers are more effective and can produce more. Improving human capital increases the quality of labor available, which causes an increase in economic growth.

- Increase in infrastructure spending

- For example, if the government sets up dependable transportation systems, then they are helping businesses get inputs to production, and get goods to customers. This means that government spending on infrastructure raises government spending and contributes to the growth of real GDP in the long run.

- Policies that spur innovation

- By creating policies that promote innovation, the government can promote economic growth in the long-run. For example, the government can create policies that protect intellectual property (patents), which would give private companies a greater incentive to create that intellectual property. By promoting creativity and entrepreneurship, we will be able to increase real GDP in the long run.

- Increasing employment

- By increasing employment, more workers will lead to increased productivity, thus leading to economic growth.

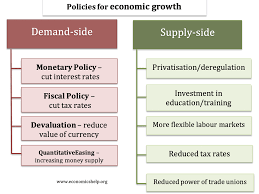

Image Courtesy of Economics Help

Supply-Side Economics

Supply-side fiscal policies are laws designed to increase output by shifting SRAS and LRAS by lowering taxes for businesses. It's the opposite of demand-side economics, and it's the idea that cutting taxes and reducing regulations within the firms and businesses. This will then increase the production, thus increasing supply. When supply is increased, GDP increases but price level is decreased.

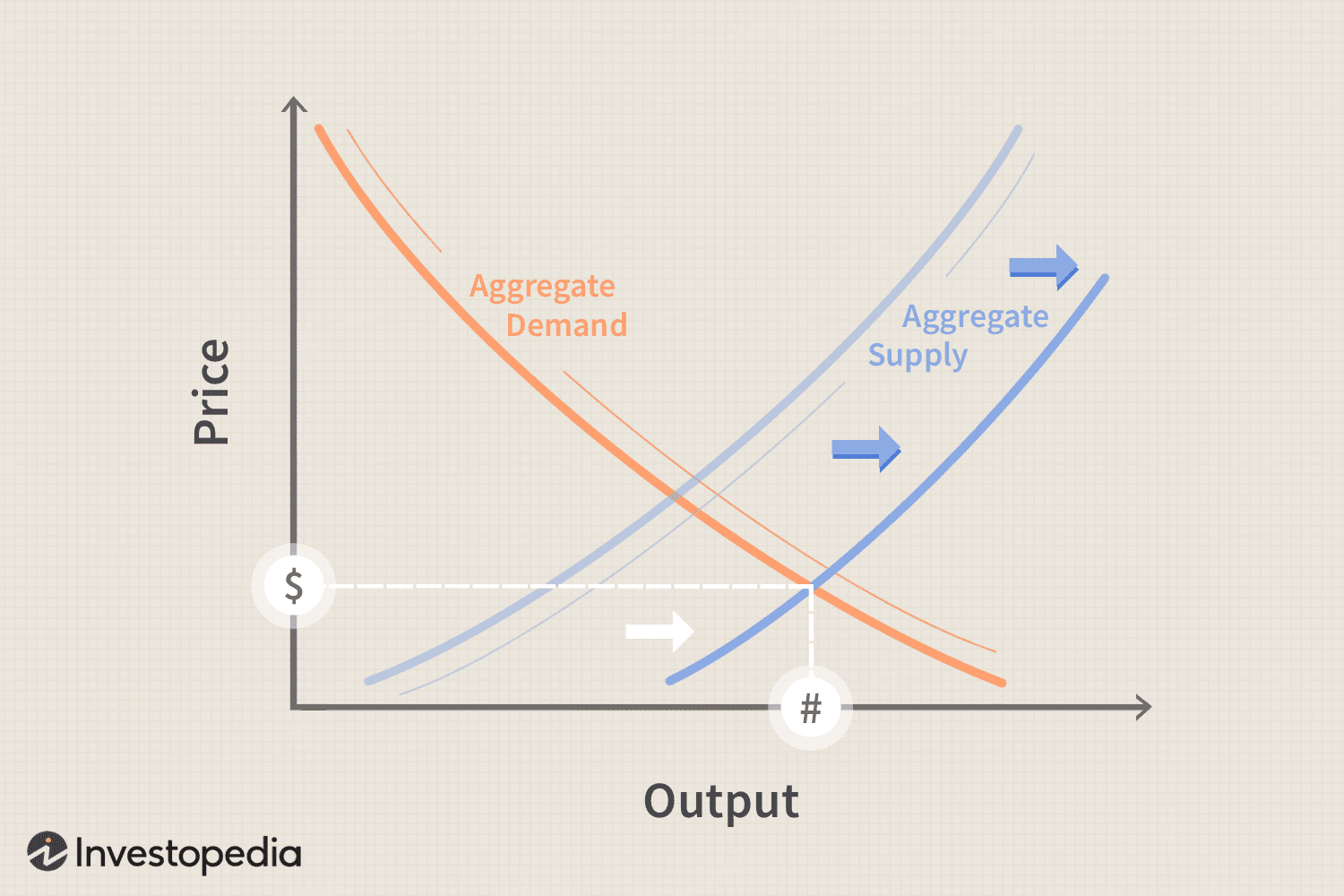

Image Courtesy of Investopedia

Instead of shifting demand to the right as most fiscal policies do, supply-side policies focus on the supply. Most fiscal policies therefore are called demand side policies. Previously, AD was moved in order to bring the economy back closer to full employment. It's more of a higher governmental intervention on the economy.

Some economists argue that the government shouldn't manipulate AD too much. Instead, they believe the government shouldn't intervene on the economy as much. These economists believe that without governmental intervention, the economy will correct itself. However, when the economy seriously needs government help, these economists argue the government should focus more on supply rather than demand.

Supply side economics basically states that by shifting supply to the right, aggregate demand, aggregate supply and output are all affected in the short run. They all will increase. In the long run, incentives will be changed. If taxes are cut and regulations are reduced, firms will feel more incentive to produce more because costs are now smaller. It's a way of increasing real GDP without high inflation.

Saving and Investment

With lower taxes, income will increase. That would encourage saving, and increase the supply of loanable funds, then decrease the real interest rate, and then lastly increase investment. It's a perfect cycle of what we want in the economy. In addition, supply side economists think we should have something called investment tax credit, which reduces a firm's taxes if it invests. Cool right?

Looking at the same effects at a different angle: if taxes are cut, more income is available for households and it increases spending. Then it'll increase the profits of the firms and increase producing! This would increase the productive capacity (PPF) and LRAS as well (remember, growth! 🌱)

**Supply side economic policies increase investment and saving leading to growth **

Demand Side of Things

Not all economists agree with this, but it's certainly a great idea! Good things lead to more good things! Supply side economists, in order to support their claim, argue that supply side policies also increase demand as well.

- productivity incentive- lower taxes --> higher income --> workers become more productive- People lose the incentive to work when a lot of their income is taken away by taxes. If these taxes are lower, more people will work harder because less of their earned wages is not taken away. This motivates them and will increase employment too because now people will work at lower wages (because less is taken away by taxes again). That makes citizens less dependent on the government and its social programs and more independent.

- risk-taking- Investors start taking big risks because tax is lower meaning profits are higher.- With lower taxes, the expected income from investing will increase and encourage more investment.

© 2024 Fiveable Inc. All rights reserved.